United Arab Emirates

Government investment in infrastructure and growth in foreign trade will spur GDP growth.

UAE has the second largest economy in the GCC (after Saudi Arabia), with a gross domestic product (GDP) of $377 billion (1.38 trillion AED) in 2012. Since independence in 1971, UAE’s economy has grown by nearly 231 times to 1.45 trillion AED in 2013. The non-oil trade has grown to 1.2 trillion AED, a growth by around 28 times from 1981 to 2012. UAE is ranked as the 26th best nation in the world for doing business based on its economy and regulatory environment, ranked by the Doing Business 2017 Report published by the World Bank Group.

Although UAE has the most diversified economy in the GCC, the UAE’s economy remains extremely reliant on oil. With the exception of Dubai, most of the UAE is dependent on oil revenues. Petroleum and natural gas continue to play a central role in the economy, especially in Abu Dhabi. More than 85% of the UAE’s economy was based on the oil exports in 2009. While Abu Dhabi and other UAE emirates have remained relatively conservative in their approach to diversification, Dubai, which has far smaller oil reserves, was bolder in its diversification policy. In 2011, oil exports accounted for 77% of the UAE’s state budget. Successful efforts at economic diversification have reduced the portion of GDP based on oil/gas output to 25%. Dubai suffered from a significant economic crisis in 2007–2010 and was bailed out by Abu Dhabi’s oil wealth. Dubai is running a balanced budget, reflecting economic growth. Tourism acts as a growth sector for the entire UAE economy. Dubai is the top tourism destination in the Middle East. According to the annual MasterCard Global Destination Cities Index, Dubai is the fifth most popular tourism destination in the world. Dubai holds up to 66% share of the UAE’s tourism economy, with Abu Dhabi having 16% and Sharjah 10%. Dubai welcomed 10 million tourists in 2013. The UAE has the most advanced and developed infrastructure in the region. Since the 1980s, the UAE has been spending billions of dollars on infrastructure. These developments are particularly evident in the larger emirates of Abu Dhabi and Dubai. The northern emirates are rapidly following suit, providing major incentives for developers of residential and commercial property. Property prices in Dubai fell dramatically when Dubai World, the government construction company, sought to delay a debt payment.

External Trade

With imports totaling $273.5 billion in 2012, UAE passed Saudi Arabia as the largest consumer market in the region. Exports totaled $314 billion, which makes UAE the second largest exporter in the region.

UAE and India are each other’s main trading partners, with the latter having many of its citizens working and living in the former. The trade totals over $75 billion (AED275.25 billion).[25]

The top five of the Main Partner Countries of the UAE in 2014 are Iran (3.0%), India (2.9%), Saudi Arabia (1.5%), Oman (1.4%) and Switzerland (1.2%). As for the top five of UAE suppliers are China (7.4%), United States (6.4%), India (5.8%), Germany (3.9%) and Japan (3.5%).

Diversification

Although UAE has the most diversified economy in the GCC, the UAE’s economy remains extremely reliant on oil. With the exception of Dubai, most of the UAE is dependent on oil revenues. Petroleum and natural gas continue to play a central role in the economy, especially in Abu Dhabi. More than 85% of the UAE’s economy was based on the oil exports in 2009. While Abu Dhabi and other UAE emirates have remained relatively conservative in their approach to diversification, Dubai, which has far smaller oil reserves, was bolder in its diversification policy. In 2011, oil exports accounted for 77% of the UAE’s state budget.

Dubai suffered from a significant economic crisis in 2007-2010 and was bailed out by Abu Dhabi’s oil wealth. Dubai’s current prosperity has been attributed to Abu Dhabi’s petrodollars. In 2014, Dubai owed a total of $142 billion in debt. The UAE government has worked towards reducing the economy’s dependence on oil exports by 2030. Various projects are underway to help achieve this, the most recent being the Khalifa Port, opened in the Emirate of Abu Dhabi at the end of 2012. The UAE has also won the right to host the World Expo 2020, which is believed to have a positive effect on future growth, although there are some skeptics which mention the opposite.

Over the decades, the Emirate of Dubai has started to look for additional sources of revenue. High-class tourism and international finance continue to be developed. In line with this initiative, the Dubai International Financial Centre was announced, offering 55.5% foreign ownership, no withholding tax, freehold land and office space and a tailor-made financial regulatory system with laws taken from best practice in other leading financial centres like New York, London, Zürich and Singapore. A new stock market for regional companies and other initiatives were announced in DIFC. Dubai has also developed Internet and Media free zones, offering 100% foreign ownership, no tax office space for the world’s leading ICT and media companies, with the latest communications infrastructure to service them. Many of the world’s leading companies have now set up branch offices, and even changed headquarters to, there. Recent liberalisation in the property market allowing non citizens to buy freehold land has resulted in a major boom in the construction and real estate sectors, with several signature developments such as the 2 Palm Islands, the World (archipelago), Dubai Marina, Jumeirah Lake Towers, and a number of other developments, offering villas and high rise apartments and office space. Emirates (part of the Emirates Group) was formed by the Dubai Government in the 1980s and is presently one of the few airlines to witness strong levels of growth. Emirates is also the largest operator of the Airbus A380 aircraft. As of 2001, budgeted government revenues were about AED 29.7 billion, and expenditures were about AED 22.9 billion.In addition, to finding new ways of sustaining the national economy, the UAE has also made progress in installing new, sustainable methods of generating electricity. This is evidenced by various solar energy initiatives at Masdar City and by other renewable energy developments in parts of the country.

In addition, the UAE is starting to see the emergence of local manufacturing as new source of economic development, examples of significant government-led investments such as Strata in aerospace industry, under Mubadala are successful, while there are also small scale entrepreneurial ventures picking up, such as Zarooq Motors in the automotive industry.

The UAE’s economy is one of the most open worldwide, and its history of economic history goes back to the times when ships sailed to India, along the Swahili coast, as far south as Mozambique.

Current UAE’s GDP is $386.4 Billion while the individual share is almost 70 thousand dollars.

International Monetary Fund (IMF) expected UAE’s economic growth to increase to 4.5% in 2015, compared to 4.3% in 2014. The IMF ascribed UAE’s potentially strong economic growth in World Economic Outlook Report to the increased contribution of non-petroleum sectors, which registered a growth average of more than 6% in 2014 and 2015. Such contribution includes banking, tourism, commerce and real estate. Increase of Emirati purchasing power and governmental expenditures in infrastructure projects have considerably increased.

Internationally, UAE is ranked among the top 20 for global service business, according to AT Kearney, the top 30 on the WEF “most-networked countries” and in the top quarter as a least corrupt country per the TI’s corruption index.

Foreign trade

With reference to foreign trade, UAE’s market is one of the world’s most dynamic markets worldwide, placed among the 16 largest exporters and 20 largest importers of commodities. The top five of the Main Partner Countries of the UAE in 2014 are Iran (3.0%), India (2.9%), Saudi Arabia (1.5%), Oman (1.4%) and Switzerland (1.2%). As for the top five of UAE suppliers are China (7.4%), United States (6.4%), India (5.8%), Germany (3.9%) and Japan (3.5%).

In 2014, the United Arab Emirates managed to export 380.4bn dominated by four products which are Petroleum oils and oils obtained from bituminous… (19.8%) Diamonds, whether or not worked, but not mounted… (3.4%) Gold, incl. gold plated with platinum, unwrought… (3.2%) Articles of jewellery and parts thereof, of…(2.8%). In the same year, the United Arab Emirates imported 298.6 bn dominated by five countries which are China (7.4%), United States (6.4%), India (5.8%), Germany (3.9%), Japan (3.5%).

On one hand, the United Arab Emirates managed in 2013 to export 17 bn USD services exported in 2013 dominated by travel (67.13%), transportation (28.13%), Government services (4.74%). On the other hand, it imported 63.9 bn USD of services imported services dominated by transportation (70.68%), travel (27.70%) and government services (1.62%).

Real Estate

The development in the real estate and infrastructure sectors during the recent year has contributed in making the country a global touristic destination. The contribution of tourism in the Emirati GDP increased from 3% in the mid-1990s to more than 16.5% by the end of 2010. This trend is supported by the huge public investments in touristic projects (47 Billion Dollars per year) carried mainly to expend airports, increase their capacity, set up new airports and ports.

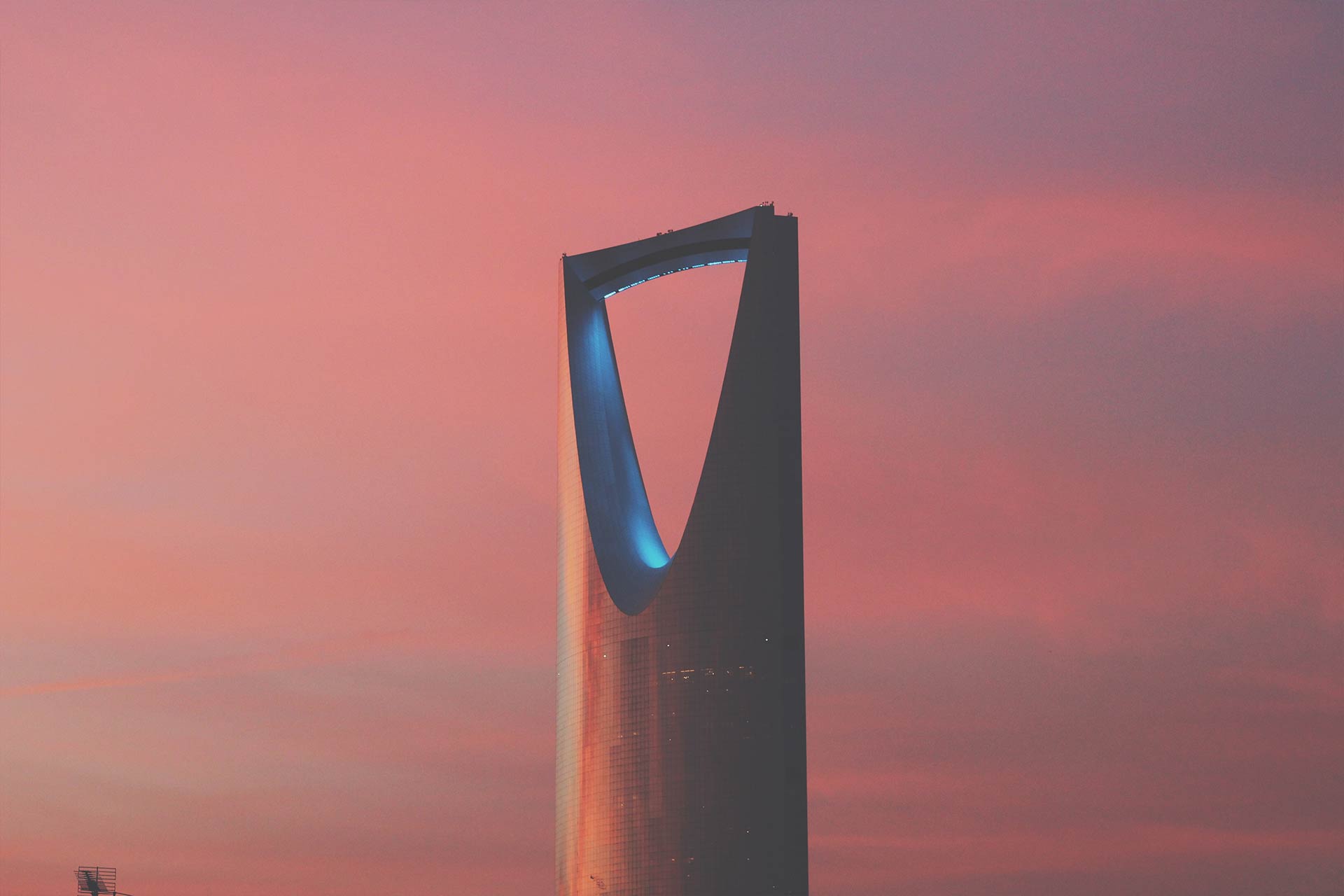

The real estate sector have a positive impact on development, job opportunities, investments and tourism as estate projects were launched to meet the needs of market and the increasing demand for housing and commercial units especially in Dubai and Abu Dhabi. The UAE has 18 tour hotels out of the 155 (150 meters high) that exist around the world. This makes the UAE the third destination with such tours after China and America in 2014. These buildings are among the UAE’s attractions for tourists.

The leap in real estate sector along and infrastructure development in the UAE during the recent year has contributed in making this country a global touristic destination par excellence. Therefore, the contribution of tourism in the Emirati GDP increased from 3% in the mid-1990s to more than 16.5% by the end of 2010. This trend is supported by the huge public investments in touristic projects (47 Billion Dollars per year) carried mainly to expend airports, increase their capacity, set up new airports and ports.

The UAE has 18 tour hotels out of the 155 (150 meters high) that exist around the world. This makes the UAE the third destination with such tours after China and America in 2014. These buildings are among the UAE’s attraction elements for tourists. Dubai has adopted dazzling ideas in construction and design of these tall tours.

The UAE has about 37% of the region’s petroleum and gas industries, chemical industries, energy and water and garbage projects. The UAE’s government have been injecting huge funds in tourism and real estate projects, especially in Abu Dhabi and Dubai. Al Saadiyat Island in Abu Dhabi and Burj Khalifa in Dubai, the tallest tower in the world, world central near “Jebel Ali” are a point in case of the milestones that have given the UAE its high profile of a global tourist destination. According to 2013-2014 Global Competitiveness Report, the UAE ranked fourth worldwide in terms of infrastructure quality.

Transport

Dubai International Airport was the busiest airport in the world by international passenger traffic in 2014, overtaking London Heathrow. A 1,200 km (750 mi) country-wide railway is under construction which will connect all the major cities and ports. The Dubai Metro is the first urban train network in the Arabian Peninsula. The major ports of the United Arab Emirates are Khalifa Port, Zayed Port, Port Jebel Ali, Port Rashid, Port Khalid, Port Saeed, and Port Khor Fakkan.

The UAE is served by two telecommunications operators, Etisalat and Emirates Integrated Telecommunications Company (“du”). Etisalat operated a monopoly until du launched mobile services in February 2007. Internet subscribers were expected to increase from 0.904 million in 2007 to 2.66 million in 2012.[288] The regulator, the Telecommunications Regulatory Authority, mandates filtering websites for religious, political and sexual content.

Expo 2020

UAE launched a successful bid for Expo 2020 with Dubai. The win is unprecedented in the region. World Expos are a meeting point for the global community to share innovations and make progress on issues such as the global economy, sustainable development and improved quality of life. World Expos can be a catalyst for economic, cultural and social transformation and generates legacies for the host city and nation.

Hedging & Refinancing Options

According to the Country Risk Classification published by the OECD, hedging and refinancing options are available.

*This article is licensed under the GNU Free Documentation License and Creative Commons CC-BY-SA 3.0 Unported (Abbreviated Version). The article is based on the article Economy of the United Arab Emirates from the free encyclopedia Wikipedia . In Wikipedia a list of authors is available.